introduction

For millions of people, student loans have become an unavoidable part of the higher education journey. While education undoubtedly opens doors to new opportunities, it often comes with a significant financial burden that can stretch for years, if not decades. With rising tuition costs, an increasing number of students and families are relying on loans to finance their education. But what many don’t talk about is the emotional weight that this debt can carry. The pressure of repaying student loans, alongside the emotional strain they cause, can affect mental health in ways that go beyond simple financial stress. Navigating student loans and safeguarding mental well-being requires a balanced approach, acknowledging both the financial and psychological challenges that accompany them.

The Escalating Reality of Student Debt

Education, once viewed as a fundamental step toward career advancement, has become a steep financial investment in today’s world. In the United States, student loan debt has skyrocketed to over $1.7 trillion, with more than 44 million borrowers across the country. Higher education has proven to be a ticket to better career prospects and earning potential, but the burden of repaying loans often overshadows these benefits.

The average student graduates with a mounting debt that can extend well into their 30s or even 40s. With loan repayment often stretching over several decades, this burden can feel insurmountable. Compounding this financial stress is the challenge of entering the workforce, where high-paying jobs may not be immediately available. These factors can intensify feelings of anxiety, frustration, and even hopelessness, leaving borrowers unable to fully enjoy the fruits of their education.

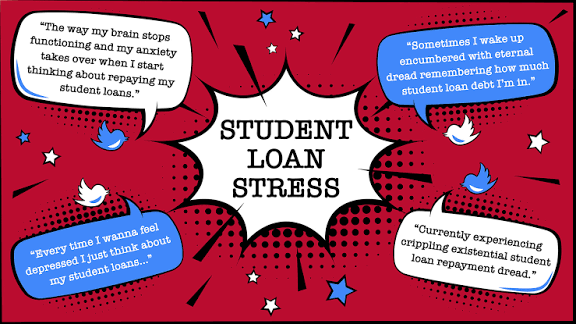

The Emotional Impact of Student Loans

While student debt is typically discussed in terms of financial obligations, its emotional and psychological effects are often overlooked. The weight of this debt can lead to significant emotional distress, resulting in feelings of shame, guilt, and overwhelming anxiety. Over time, these emotions can grow more intense, affecting a person’s overall mental health.

1. Chronic Stress and Anxiety

Managing student loans demands constant attention. Borrowers must juggle repayment schedules, interest rates, and potential changes to their loan terms. The sheer amount of information to track, combined with the anxiety about making timely payments, can leave borrowers on edge. This persistent worry can have a detrimental effect on other aspects of life, such as relationships, sleep quality, and general well-being. For many, financial anxiety leads to difficulty focusing on anything else, creating a cycle of stress that is hard to escape.

2. Depression and Despair

The financial strain caused by student loans can lead individuals to feel trapped. The relentless pressure to make ends meet and stay on top of payments can result in a deep sense of hopelessness. Some borrowers might feel that their efforts to gain a higher education were ultimately futile, only leading them into more debt. This feeling of being stuck can spiral into depression, where borrowers begin to question their choices and their future prospects, further adding to the emotional toll.

3. Social Isolation and Stigma

Student loan debt is often accompanied by feelings of embarrassment. Many borrowers hesitate to discuss their financial struggles with family or friends, out of fear that others won’t understand or will judge them. This social stigma can make the burden feel even heavier, leading individuals to withdraw from social connections and spiral into isolation. Over time, the sense of being alone in their struggles can make borrowers feel even more disconnected, exacerbating mental health challenges.

4. Fear of the Future

Student debt casts a long shadow over one’s future, affecting long-term goals like buying a home, starting a family, or saving for retirement. Many borrowers find themselves stuck in a constant state of anxiety about their financial future. This looming fear can cloud day-to-day happiness and hinder personal growth, leaving individuals unable to plan for their goals, let alone feel confident in their ability to achieve them.

The Link Between Financial Strain and Mental Health

The connection between financial stress and mental health issues is well-documented. People who face persistent financial uncertainty are more likely to experience a variety of mental health disorders, such as depression, anxiety, and even substance abuse. For those managing student debt, the burden can be particularly overwhelming. The pressure to repay loans while navigating uncertain financial futures can create a mental health crisis for many individuals.

Financial instability often feeds feelings of inadequacy and regret. Borrowers may question whether their education was worth the financial sacrifice, amplifying the stress that comes with debt. The constant worry about money and repayment can lead to a sense of powerlessness, which in turn fuels further mental health struggles.

Strategies for Managing Debt and Mental Health

While student loan debt can undoubtedly take a toll on mental health, there are ways to manage it effectively. A proactive approach to both the financial and emotional challenges of student debt can make a significant difference in reducing stress and protecting mental well-being.

1. Establish a Solid Budget

A detailed and realistic budget is one of the most powerful tools in managing debt. By organizing finances and accounting for monthly payments, living expenses, and savings, borrowers can feel more in control of their situation. Having a clear financial plan also makes it easier to track progress toward paying off the loan, which can provide motivation and a sense of accomplishment as payments are made.

2. Seek Professional Financial Advice

Navigating the complexities of loan repayment options—such as income-driven repayment plans, deferment, or consolidation—can be overwhelming. Consulting with a financial counselor or loan expert can provide clarity on available options, ensuring that borrowers are taking the best course of action to manage their debt. Knowing that there are professional resources available can alleviate some of the emotional burden of debt management.

3. Explore Loan Forgiveness Programs

In certain fields, such as public service or non-profit work, borrowers may be eligible for loan forgiveness programs. These programs can dramatically reduce the total amount of debt to be repaid, providing a much-needed sense of relief. Researching and applying for loan forgiveness options can offer hope and an attainable pathway to financial freedom, making the burden of student debt feel more manageable.

4. Incorporate Mindfulness and Stress-Relief Practices

Incorporating mindfulness and relaxation techniques into daily life can significantly reduce stress. Practices such as meditation, yoga, or deep breathing exercises help to manage anxiety and restore emotional balance. Additionally, regular physical activity, maintaining a healthy diet, and prioritizing sleep all contribute to improved mental health. Small but consistent efforts to care for the body and mind can help borrowers manage stress more effectively.

5. Share Your Burden

It’s essential for borrowers to talk about their struggles with trusted individuals. Sharing the emotional load with a close friend, family member, or therapist can provide valuable support and perspective. Sometimes, just knowing that others understand can relieve feelings of isolation and shame. Open conversations can also lead to practical advice or new strategies for managing debt, helping borrowers feel less alone in their journey.

6. Address Your Debt Head-On

Procrastination is a common reaction to overwhelming debt, but it only exacerbates stress. The longer borrowers delay dealing with their loans, the more complicated the situation can become. Taking proactive steps—whether that means making payments, seeking advice, or researching repayment options—helps regain a sense of control. Facing student debt directly can reduce feelings of helplessness and prevent the situation from escalating.

7. Focus on the Long-Term Picture

It’s easy to feel consumed by student debt in the moment, but it’s important to keep the long-term perspective in mind. Many borrowers successfully pay off their loans over time, achieving financial freedom and stability. By staying focused on the end goal and acknowledging the progress made, individuals can maintain hope and motivation, even in the midst of challenges.

Conclusion

Student loans are undeniably a financial burden, but their emotional toll is often underestimated. The stress, anxiety, and depression that come with student debt can significantly affect one’s mental health, making it harder to move forward with confidence. However, by taking a proactive approach—such as budgeting, seeking financial advice, exploring forgiveness programs, practicing mindfulness, and opening up about struggles—borrowers can navigate this complex issue with greater peace of mind. While the road to financial freedom may be long, it’s possible to manage both student debt and mental health with careful planning, emotional support, and self-care.